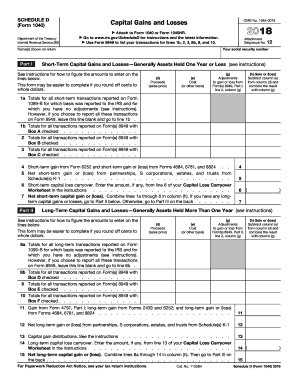

2024 1040 Schedule Caste – Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . Complete IRS 1040 Schedule C, “Profit Or Loss From Business.” On the Schedule C, you are required to enter your name, Social Security number, business name (if applicable), business address .

2024 1040 Schedule Caste

Source : www.signnow.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comSaint George Parish | Facebook

Source : m.facebook.comForests | January 2024 Browse Articles

Source : www.mdpi.com2023 2024 LCPS Guide & Directory by lcpspio Issuu

Source : issuu.comCourse Search Results MyUI

Source : myui.uiowa.eduCalifornia’s anti caste discrimination bill controversy is not

Source : slate.comImmigration.ca Colin Singer, Canada Immigration Lawyer | Montreal QC

Source : m.facebook.com2023 2024 LCPS Guide & Directory by lcpspio Issuu

Source : issuu.com20 top Thrift finds for sustainable home decor ideas in 2024

Source : www.lemon8-app.com2024 1040 Schedule Caste Irs S 1040 Schedule D 2018 2024 Form Fill Out and Sign Printable : To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

]]>